You can’t manage a small business without a budget. It’s impossible.

We have clients that make 6-figures or 7-figures per year in sales but have nothing left to pay themselves.

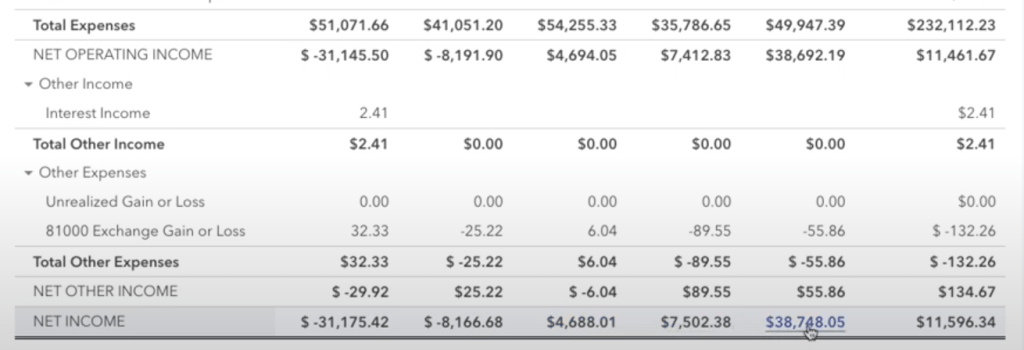

For example, this is the P&L from one of my clients. They were making over half a million dollars in sales and were operating at a steep operating loss.

Within 6-months, we created a budget, held her accountable for it, and flipped that operating loss completely around.

As a result, they just had their highest profit margin, EVER.

We’re on a mission to help you do the same.

So in this post, we’re going to simplify small business budgeting and help you get started.

By the end of this blog post, we promise you that you will have a clear understanding of where to start with your budget and how to get started.

As licensed CPAs and founders of multiple companies, we are going to show you how we create budgets for businesses we own and for our clients.

So let’s jump right into it.

We’ll be honest.

It literally hurts us to our core to see people build very successful businesses, pay their employees and vendors, and aren’t even able to pay themselves what they deserve.

Even worse, sometimes they aren’t even to pay their expenses, employees, or debt payments, and they spiral out of business as a result.

We’ve seen it. And we don’t want another business to suffer like this again.

Now, we know what you’re thinking…

Budgeting, accounting, and everything related to it is probably not the funnest thing in the world for you as a business owner.

We’ve heard it all from…

“Hey, I just want to run my small business and do what I love to do, not create a small business budget.”

Or…

“Hey, I don’t need a budget. I just log in to my bank account before making purchases to make sure I have enough to cover it. That works for me!”

Then, it eventually turns into…

“Oh, wait a ******** minute. I have to pay WHAT in taxes? Are you kidding me? I don’t have that money right now. You suck! I have to find another accountant. What are self-employment taxes anyway?”

Or …

“Hey, I’m bleeding man. I’m making money but it’s just not showing up in my bank account anymore. It was at first but as we have grown, it’s just flying out of control. What can I do?”

If you’re following our drift here, you can see how easy it is to ignore your accounting until things get really bad.

Our goal today is to prevent you from dealing with headaches like this in the future.

They aren’t fun. It’s very stressful and to be honest, deadly.

A small business budget is the most fundamental part of managing your business finances.

You need to set a budget, track it, measure it against your actual situation, and figure out what went right or wrong.

You should be looking at this every single month.

With that said, let’s break down small business budgeting to its roots and get you squared away to work on your own budget.

What is a budget?

Put simply, a budget is a financial plan to utilize the resources derived from sales.

The word “sales” is very important here. All business budgets start with a sales projection.

Using your sales projection, you can determine what expenses are required to operate your business.

And ideally, you can set limits for various expenses that you have so you can ensure that your business is profitable.

Why is Small Business Budgeting Important?

1. A budget guarantees profitability.

If you set a budget and follow it, there’s no way that your business will not be profitable.

You should budget in your desired profit margin and if everything goes according to plan, you’ll be running a successful business.

2. A budget prevents the mismanagement of incoming funds in your business.

A budget forces you to prioritize the expenses you take on.

For example, with our marketing agency, LYFE Marketing, we wanted to grow very quickly.

So by nature, we wanted to spend heavily on advertising and marketing. And inherently, we wanted to do all the marketing in the world.

Whether it was Facebook ads, Google Ads, SEO, social media, or outbound sales, we were prepared to spend whatever it took to grow our business.

And, we could have easily overspent our funds due to our aggressiveness.

Luckily, we had a budget in place and agreed to not exceed it for any reason.

Like literally, if our budget could talk, she’d say, “Wait, Wait, Wait a minute NOW! You can’t afford all of this.”

Our budget forced us to pick only a few marketing opportunities that we believed would yield the highest return.

And if and when those things didn’t pan out, we’d swap it with other things we wanted to try.

3. A budget creates a plan for every dollar in your business

It’s so easy to log in to your bank account to see if you have enough money before buying something.

But that’s not sustainable. You can spend yourself out of business with this approach.

Or, you may not save enough to pay your taxes later. Then you’d have to deal with the IRS and risk your business being shut down.

As Dave Ramsey says, every dollar should have a destination in your business.

A good budget will assign values to each destination in your business, which ultimately you have control over.

For example, let’s say you plan to make $100,000 in sales this year.

A good budget will take that sales number and say…

“Okay, we’ll spend 10% on marketing, 40% on salaries, 10% on rent, and 10% on tools and software we use, and shoot for a 30% profit margin.”

Whether you make $70,000.00 or $150,000.00, your budget will spit out what you can do at that time, and remain profitable.

Small Business Budgeting: 4 Steps on How to Create One

By now, you should know what a budget is and why it is important.

Now, let’s talk about how to start building your budget, without all the bells and whistles. Here are the steps you need to take.

Step 1: Determine your business goals

The very first step in determining your budget is to first determine your business goals.

Are you looking to increase sales? If so, by how much? What expenses are necessary to accomplish that?

Or, maybe you’re looking to improve your product or service, what improvements will you make? What impact will it have? How much will it cost?

Even wilder, maybe you want to buy a business. What’s the revenue of that business? How much are you willing to pay to acquire it?

Your business goals should be top of mind when creating your budget.

Knowing this will help you determine how much to allocate to certain expenses.

Step 2: Forecast Sales

All business budgets start with a sales forecast. And don’t worry, you don’t have to whip out a complicated spreadsheet for this.

We’ll admit that there are simple ways to do this and more sophisticated ways. For the purposes of this post, we’ll cover the simple ways.

If you’re starting with nothing, you’ll probably have to guesstimate your sales forecast based on what is common in your industry.

Or if you know the marketing channels you plan to invest in, and the correlated KPIs & associated returns, you can potentially project this based on those KPIs.

If you’re already in business, then this process becomes very simple.

A simple and conservative way to project your sales is to look at your sales numbers from prior years and compute the growth rate.

You’ll want to know how much, on average, you’re growing from year to year.

Once you know this, you can apply that % to the sales you made last year to arrive at your annual sales budget.

Step 3: Allocate a percentage to each of your expenses

Once you have your projected sales, you can start assigning a destination for those funds.

Think of your major expense categories in your business, like accounting, advertising, technology, employee salaries, and so on.

Then, assign a reasonable allocation to them based on what you expect you may spend.

For example, let’s say you projected $1.3 million dollars in sales. You can then break that down into expenses that you expect to have.

You can also find out the average expense categories and profit margins in your industry specifically to help you with this.

You will likely have to pay for this type of research or go through a firm like us to help you find that type of information.

Anyway, the biggest thing here is to carefully consider all expense categories in your business and assign a reasonable allocation to them.

Bonus Tip: Budget your own salary.

Be sure to account for your own salary in your budget.

Your salary should be accounted for in the employee salaries or in another area, but NOT in profit.

This is especially important for new businesses.

We made the mistake of not budgeting our own salaries in our first company and thought we were “profitable” enough.

Later, we had to hire managers to replace our work in the company and it was challenging because we never had budgeted the actual work we performed in our own company.

By budgeting in your own salary, you can plan to replace yourself in the event you need to work on something else in your business.

Or, maybe you just want the business to run on its own.

Regardless, budget it in.

Step 4: Convert percentage into dollar amounts

The final amount is to apply your projected sales to the expense percentages to see the actual dollar amount of your budget.

Simply multiply your projected sales by your expenses.

Now since you did this based on your annual sales and not monthly, you can later convert this into monthly budgets by simply dividing by 12.

And that’s it! You will have your budget and can hold yourself accountable.

You don’t need a fancy template to do this. You can do everything we just mentioned by using basic multiplication and division.

If you’d like custom help for your business, then be sure to check out our full-service accounting services or more specifically, our small business CFO services.

Small Business Budgeting Takeaways

Here are the major takeaways from this post:

- What is a business budget?

A budget is simply a financial plan to utilize the resources derived from sales.

- Why is budgeting important?

First and foremost, not having a budget will lead to issues in your business or with the IRS if you’re managing your business finances correctly.

That aside, a budget also helps you maintain profitability, prevents mismanagement of funds and overspending and assigns a place for every dollar in your business.

- What are the steps to creating a budget?

The steps to creating your budget are to:

1. Identify your business goals.

2. Forecast your sales.

3. Allocate the expenses to which your sales will be allocated to.

4. Multiply your projected sales by your expense allocations to arrive at your budget.